Watch the on-demand recording here

✅ Webinar Summary

Hosted by: RSI (Reference Services, Inc.)

Presenters: Stephanie Pier, Brad Odil, Alicia Barker

Purpose: Quarterly update on compliance topics in background screening

🚀 Q4 Compliance Update: Your Essential FCRA Playbook

This summary covers the key takeaways from the Reference Services Inc (RSI) “Q4 Compliance Update – Beyond the Background Check” webinar. The presentation focused on essential FCRA compliance for end-users of Consumer Reporting Agencies (CRAs).

Key Reasons to Use a CRA like RSI

Using a CRA is vital for businesses to ensure compliance, efficiency, and make informed, verifiable decisions.

- Compliance: Using CRAs helps businesses comply with the Fair Credit Reporting Act (FCRA) and other laws, which ensures transparency and fair treatment.

- Efficiency: CRAs offer comprehensive reports, which is more efficient than gathering data from thousands of individual sources.

- Verification: Employers use background checks to verify candidate information for informed hiring decisions.

🛡️ End-User Responsibilities and Compliance

End-users (employers/landlords) have key responsibilities when utilizing consumer reports.

- Obtain Permission: Secure written consent from the consumer.

- Provide Notices: Give the Consumer Authorization and Disclosure and the Summary of Rights.

- Ensure Accuracy: Work with the CRA (RSI) to confirm report accuracy.

- Appropriate Use: Use the information solely for employment or tenancy, protect against discrimination, and safeguard consumer rights.

Common Compliance Claims and Concerns

Consumer complaints are on the rise, with FCRA complaints increasing by 36.4% year-to-date. Common claims against CRAs and end-users include:

- Non-Compliant FCRA Disclosures: Often involving extraneous language.

- Adverse Action Process Failures: Specifically, failing the required two-step process.

- Conviction/Arrest Record Discrimination: Failure to show a relationship between a conviction and the job function.

🔍 Best Practices for Criminal Reporting and Report Viewing

- Review of RSI’s Standard Reporting Scope: RSI adheres to a 7-year reporting scope but can customize it for clients.

- Under current Federal Rule, convictions are reportable forever, while non-convictions (pending/deferral) are reportable for 7 years from the charge or file date.

- RSI reports major felony convictions (e.g., violence, sex crimes) for life under federal law.

- Nine states already impose a 7-year restriction on conviction reporting.

- Report Verification: For accuracy, most records must be verified at the local County Court. For instance, CRAs cannot report from public access databases like PACR or Pennsylvania Access To Criminal History (PATCH) due to accuracy and permissible purpose concerns.

- Viewing Reports: End-users should read the entire report and not rely on the Summary section when making a hiring decision, as the Summary doesn’t define the level of the “alert”.

- Social Security Trace/Address History: Social Security Trace results and address history cannot be used for employment/eligibility decisions and should not be included in the consumer report.

📝 Adverse Action Process

The adverse action notice informs an individual that they have been denied a benefit (e.g., employment) based on report information.

- The process involves a Pre-Adverse notice, a wait of approximately 5 business days, and then a Post-Adverse notice.

- Clients should check specific state regulations, such as in Illinois, California, and New York.

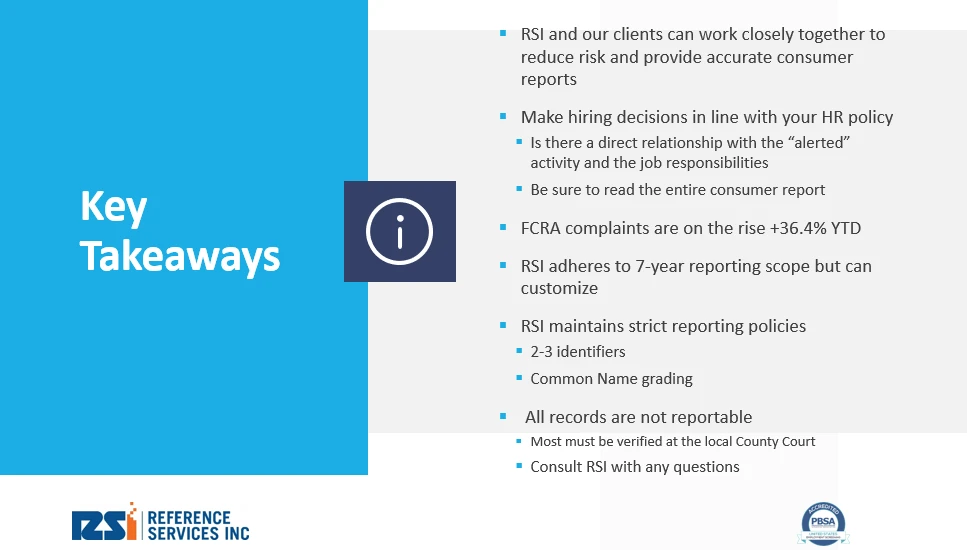

📌 Key Takeaways

1. Risk Reduction and Accuracy (RSI & Client Collaboration)

- Partner to Reduce Risk: RSI and clients should work closely together to reduce risk and provide accurate consumer reports.

- Consult RSI: Always consult RSI with any questions you may have regarding compliance or reports.

2. Hiring Decisions and Job Relevance

- Policy-Driven Decisions: Make hiring decisions in line with your organization’s HR policy.

- Direct Relationship: Ensure there is a direct relationship between the “alerted” activity (the negative information found) and the responsibilities of the job. This helps protect against claims of discrimination.

3. Report Viewing Best Practices

- Read the Entire Report: Be sure to read the entire consumer report.

- Avoid Summaries: Do not rely on the Summary section when making a hiring decision, as the Summary does not define the level of the “alert”.

- Non-Hiring Information: Information like a Social Security Trace or Address History is not Consumer Report Information and cannot be used in making employment decisions.

4. Compliance Environment and Dispute Trends

- FCRA Complaints Rising: FCRA complaints are significantly on the rise, increasing by +36.4% Year-to-Date (YTD) as of October 2025.

- Low Dispute Rate: RSI maintains a low dispute rate (6/100th of 1% in 2025) by following strict standards.

- Adverse Action Compliance: The Adverse Action process requires a mandatory two-step process (Pre-Adverse, wait 5 days, then Post-Adverse) and clients must check specific state regulations.

5. Reporting Standards and Scope

- Strict Reporting Policies: RSI maintains strict reporting policies, requiring 2-3 identifiers for matching and using common name grading.

- Verification is Key: All records are not reportable, and most must be verified at the local County Court level

Compliance Questions: compliance@referenceservices.com

General Help: help@referenceservices.com

PDF copy of our presentation here: Q4 Compliance Update – 30 Minute Lunch & Learn Webinar

Reference Services, Inc. is dedicated to ensuring client satisfaction by delivering exceptional customer service. Our U.S.-based team offers solutions designed to help clients build a safe, productive, and dependable workforce, utilizing cutting-edge technology. With our expertise and experience, RSI provides swift and precise reports at an unmatched value.

Our promise to you – QUALITY data with the industry’s best accuracy, SPEED with reports returned within hours, SIMPLICITY with easy-to-use software & integrated ATS, and CUSTOMER SERVICE beyond your expectations.